I hope you and your family are well and have enjoyed the summer. Fall is approaching and the “new normal” continues as students head back to school, whether virtually or in person, and many people continue to work from home.

Globally, the number of COVID-19 cases surpassed 24.4 million in August as reported by Johns Hopkins University. However, infection rates are slowing in many parts of the world. Although some countries have experienced second waves of the virus, many are in recovery mode.

Here is a brief update with some of the month’s developments and related thoughts.

Macroeconomic and market developments

- In an effort to support the labour market and broader economy, U.S. Federal Reserve (“Fed”) Chairman Jerome Powell announced a major shift to “average” inflation targeting. This means the Fed will allow inflation to trend moderately above the 2% target to offset extended periods of below-target inflation.

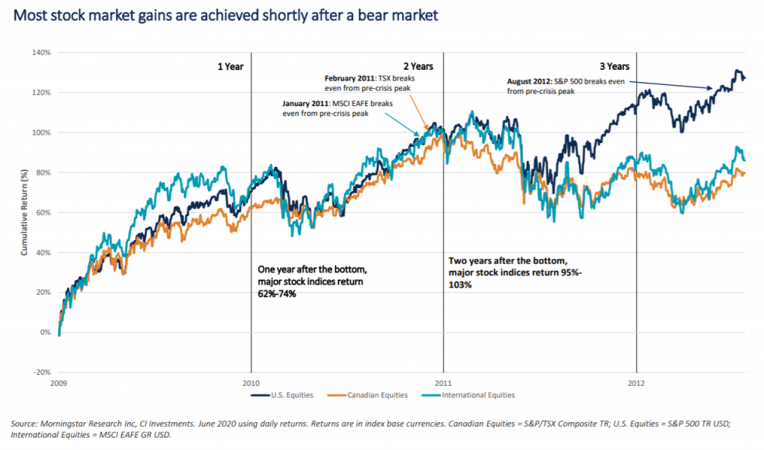

- The S&P 500 Index, a broad measure of U.S. equity returns, reached an all-time high in August, following the pandemic-induced downturn during February and March. The upward move marks the index’s fastest-ever recovery from a bear market (defined as a steep price decline, typically exceeding 20%).

- COVID-19 continued to take its toll on Canada’s real gross domestic product (GDP), which declined 38.7% in the second quarter of 2020 – the largest decline on record. However, preliminary data from Statistics Canada indicated a 3% increase in real GDP for July, suggesting that the economy may have turned a corner.

- A partnership between China and Canada to carry out Canada’s first clinical trials of a potential COVID-19 vaccine was abandoned amid tensions between the two countries. However, there are a number of other vaccine candidates in development around the world. In August, Canada announced deals to reserve millions of doses of potential vaccines from U.S. pharmaceutical firms Moderna, Pfizer, Johnson & Johnson and Novavax.

How does this affect my investments?

Many global stock markets have recovered a significant portion of their losses from earlier in the year, while the U.S. market has gone on to set new records. It may seem odd for stocks to come back while there is so much economic difficulty and uncertainty. This simply reflects the forward-looking nature of stock markets and the performance of a number of large companies that have done well despite the pandemic.

Will these gains hold or can we expect more volatility? Short-term market movements are impossible to predict. As I have noted before, market declines have historically been followed by recoveries and new highs – much like we saw during August with the S&P 500 and other markets. In fact, most market gains are achieved shortly after a bear market, as shown in the chart above. By staying invested, your portfolio will be well positioned to benefit from a recovery.

0% cumulative return signifies the market bottom for the financial crisis in 2008-09.