WHAT WILL HAPPEN WHEN YOU RETIRE?

Will you be able to reap the benefits of a lifetime of hard work and wise decisions? Or, will you find that because of a lack of adequate financial planning, you cannot maintain your accustomed lifestyle? Obviously, you want to enjoy your retirement, and all the rewards you’ve earned.

The way to ensure that you achieve your goal is to start planning now!

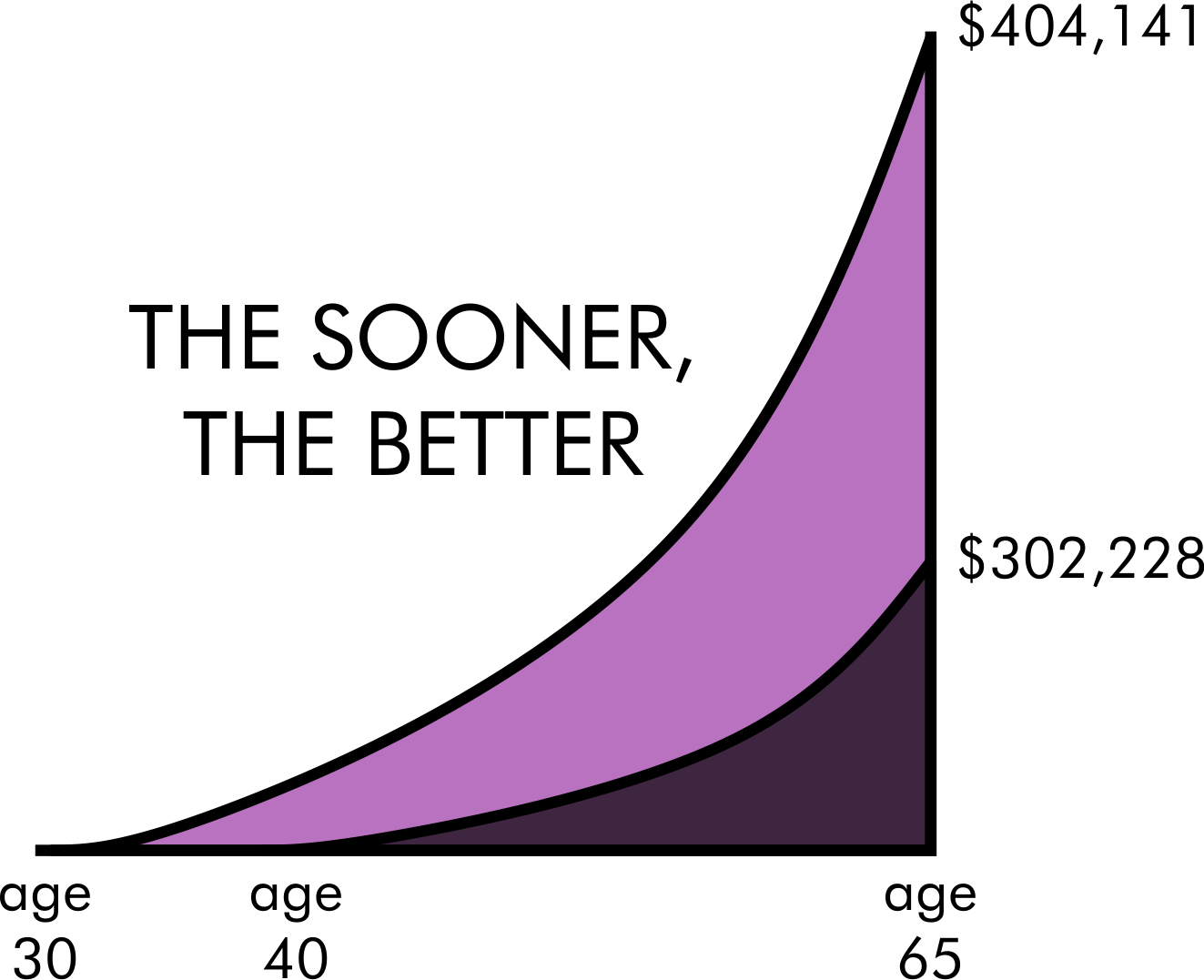

The sooner, the better.

The longer your investment time horizon, the greater the effect compounding will have on your investments. The graph below illustrates how the positive effects of compounding dramatically increase the longer the time-period of investment.

For example

An investor who, starting at age 30, invests $2000 per year until age 65 (assuming payments made at start of year), will retire with a portfolio worth $404,141 (assume an 8% annual compound rate of return). A second investor who waits until age 40 to start a savings program and invests $3,500, will have a portfolio worth only $302,228 at age 65. Even though the first investor has contributed $72,000 over 36 years, while the late starter invested $91,000 over 26 years, the first investor ends up with $101,913 more when he or she retires.

This example is provided for illustrative purposes only and is presented to show the effects of the compound growth rate based on certain assumptions.

What can you learn from this example?

Start investing now to achieve results using less money. Brown Financial offers a number of investment service options, including, but not limited to: