[vc_row row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern” css_animation=””][vc_column][vc_column_text css=”.vc_custom_1556632672882{margin-bottom: 40px !important;}”]

WHAT WILL HAPPEN WHEN YOU RETIRE?

Will you be able to reap the benefits of a lifetime of hard work and wise decisions? Or, will you find that because of a lack of adequate financial planning, you cannot maintain your accustomed lifestyle? Obviously, you want to enjoy your retirement, and all the rewards you’ve earned.

The way to ensure that you achieve your goal is to start planning now!

The sooner, the better.

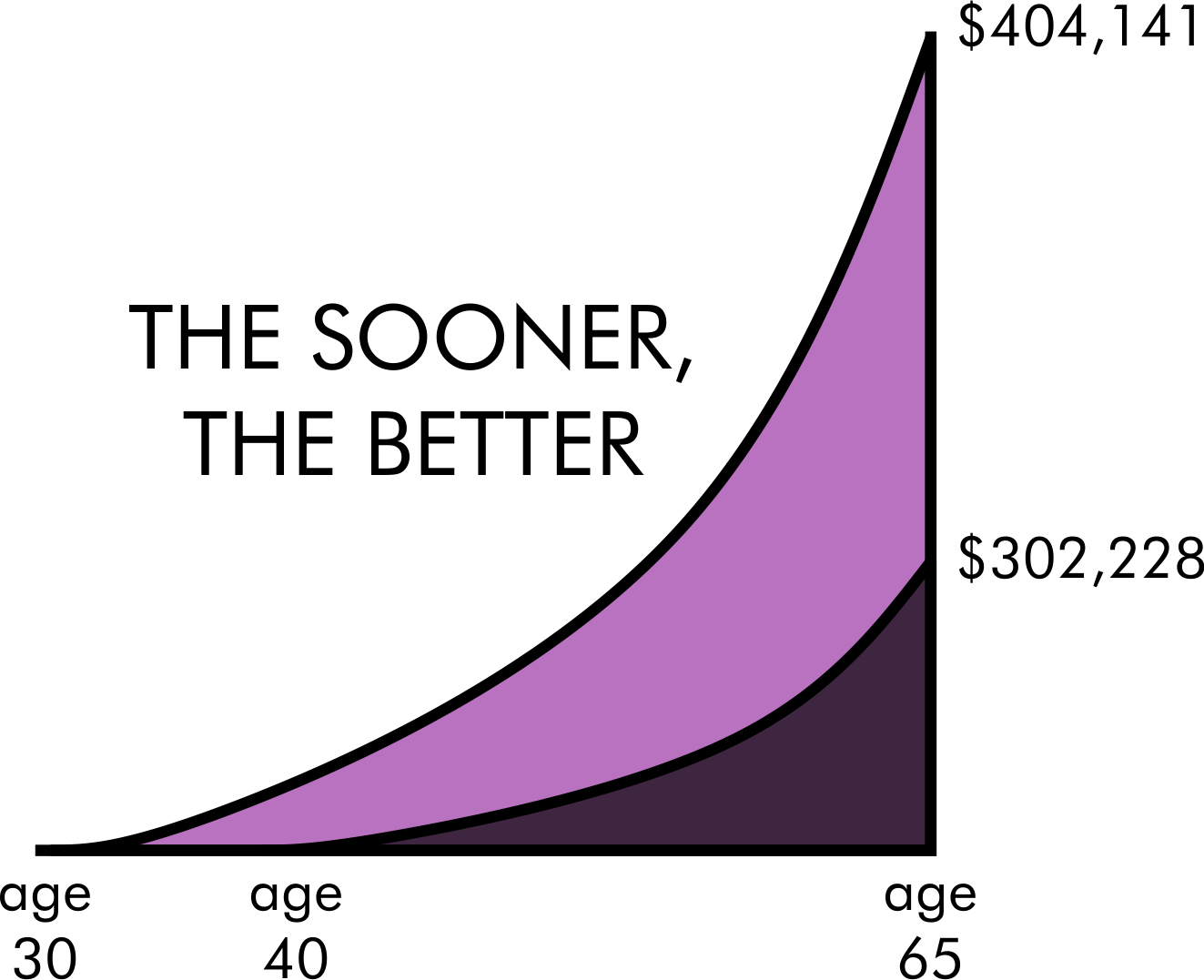

The longer your investment time horizon, the greater the effect compounding will have on your investments. The graph below illustrates how the positive effects of compounding dramatically increase the longer the time-period of investment.

For example

An investor who, starting at age 30, invests $2000 per year until age 65 (assuming payments made at start of year), will retire with a portfolio worth $404,141 (assume an 8% annual compound rate of return). A second investor who waits until age 40 to start a savings program and invests $3,500, will have a portfolio worth only $302,228 at age 65. Even though the first investor has contributed $72,000 over 36 years, while the late starter invested $91,000 over 26 years, the first investor ends up with $101,913 more when he or she retires.

This example is provided for illustrative purposes only and is presented to show the effects of the compound growth rate based on certain assumptions.

What can you learn from this example?

Start investing now to achieve results using less money. Brown Financial offers a number ofinvesment service options, including, but not limited to:[/vc_column_text][vc_accordion active_tab=”false” collapsible=”yes” style=”accordion” el_class=”accordian_add_margin_bottom”][vc_accordion_tab title=”RRSP’s” title_tag=”h3″][vc_column_text]Why Invest in RRSP’s?

To ensure a comfortable retirement, you should start by capitalizing on the great potential of a Registered Retirement Savings Plan (RRSP).

An RRSP is not only an attractive tax-saving proposition, but it is also one of your most important investment opportunities. Since tax reform has reduced the benefits of other tax shelters and has removed some investment deductions altogether, few other investments can match the RRSP protection against taxes and inflation.

Using an RRSP for retirement savings makes a lot of sense.

For example

Assuming an 8% return from interest, saving $2,000 per year will provide a portfolio valued at $157,909 at the end of 25 years. Unsheltered (Non-RRSP), however, would result in continuous tax-being paid over the investment period. Assuming a 40% marginal tax rate, the value of the portfolio would only be $97,321 – a $60,588 difference.

This example is provided for illustrative purposes only and is presented to show the effects of the compound growth rate based on certain assumptions.[/vc_column_text][/vc_accordion_tab][vc_accordion_tab title=”RRIF’s” title_tag=”h3″][vc_column_text]Registered retirement income funds are tax-sheltered plans that pay-out your accumulated registered retirement savings plan (rrsp) assets over a number of years.

With a RRIF, you have control over the pay-out schedule, you continue to choose your investment options and the assets in the RRIF continue to grow tax deferred.

Income Payments:

RRIFs allow you the flexibility of determining your own pay-out schedule. While there is no maximum withdrawal limit, the government legislates a minimum annual withdrawal which may be paid monthly, quarterly, semi-annually or annually. The minimum withdrawal formula ensures that you’ll receive an increasing percentage from the plan each year until you reach age 94, when the withdrawal is a straight 20% of the fund balance.

Investment Involvement:

You retain control of your savings and remain actively involved in all investment decisions. Brown Financial offers guaranteed interest accounts and market based funds similar to those offered through your group plan.[/vc_column_text][/vc_accordion_tab][vc_accordion_tab title=”LIF’s” title_tag=”h3″][vc_column_text]Life income funds, like rrif’s, are tax-sheltered plans but are designed to pay-out your accumulated registered pension plan or locked-in registered retirement savings assets over a number of years.

With a LIF, you determine and control your investment options but payments are determined by a government formula.

The key difference between the LIF and RRIF is that you will be required to buy a life annuity with the assets remaining in the LIF in the year you reach age 80.

[/vc_column_text][/vc_accordion_tab][/vc_accordion][vc_column_text css=”.vc_custom_1556562659643{margin-bottom: 25px !important;border-bottom-width: 1px !important;padding-bottom: 40px !important;border-bottom-color: #3e2640 !important;border-bottom-style: solid !important;}”]Contact a Brown Financial representative today, and arrange a meeting to discuss your retirement plan.[/vc_column_text][vc_column_text]

< Estate Planning | Disability >

[/vc_column_text][/vc_column][/vc_row]